Know All About General Ledger QuickBooks to Manage Your Finances

One of the most crucial aspects of business accounting is the balancing of the sheets. There’s no scope for even the minutest error. But it’s exactly here that the accounting software QuickBooks with its general ledger accounting record comes to the fore. General Ledger QuickBooks allows you to track transactions from Accounts Receivables, Undeposited Funds, Cash, and other accounts.

Thus, you get the data you need to assess the monetary health of your business. However, many people are still confused about this topic and want to know how to find this report and print it. Don’t worry, you’ll find the information you need about the crucial element in QuickBooks.

What Is General Ledger QuickBooks and Its Types

The QuickBooks General Ledger report gives users all the financial activity of their business at a glance. You can see the financial activity across various accounts for a particular date. Through a double-entry methodology, QuickBooks monitors all the entries recorded.

A specific General Ledger consists of four key parts. They include the journal entry, a transaction description, debit and credit columns to the ledger, and the account balance.

Read About:- QuickBooks Online Payroll

There are three basic journals in QB. They include:

- Payroll, which keeps a track of the wages of every employee. It also tracks checks through which they are paid and the related payroll taxes.

- Accounts Payable is the routine record of your business’s expenditures and purchases that you haven’t yet paid.

- Accounts Receivable is the routine record of your business’s revenues, sales, and bills that are yet unpaid from your clients.

Broadly speaking, there are six kinds of General Ledger accounts in QuickBooks.

- Accounts of Assets – These refer to the resources that your business owns, such as cash, debtors, inventory, etc.

- Account for Liabilities – These encompass all the sums that your enterprise owes to others. For instance, long-term credit, creditors, and exceptional expenditure.

- Shareholders Equity – It is a surplus of assets over liabilities in your business. Its examples include treasury and retained earnings.

- Accounts of Operating Income – This is the income that your central business activities generate. For example, sales and fees.

- Accounts for Operating Expenses – It is the expenditure that your business incurs for running its operations. These include salaries and rent.

- Accounts for Non-Operating or Other Income – These are one-time incomes or expenditures your business generates or incurs. Some examples are assets you sell at a loss, profit on the sale of an asset, and interest earnings.

Read About:- How to Update QuickBooks

What Data Do You Get from General Ledger QuickBooks Desktop

General Ledger allows you to produce financial statements for your stakeholders. You can also use the information to generate management reports for future decisions. As a business owner, if you suddenly find a surge in expenses, you can look into General Ledger and discover the cause.

Apart from that, your accountant can use this ledger to fix different accounting errors and maintain correct accounting records.

General Ledger in QuickBooks also assists you in distinguishing your personal money from business bills. Put simply; it helps you ensure that nothing is out of place.

Steps to Locate General Ledger in Your QuickBooks

Now that you are a lot more familiar with the General Ledger report in QB, you can learn to find it. Use these pointers to discover it.

- Sign into your QB program.

- Head to the ‘Reports’ area.

- Here, opt for the ‘Standard’ tab.

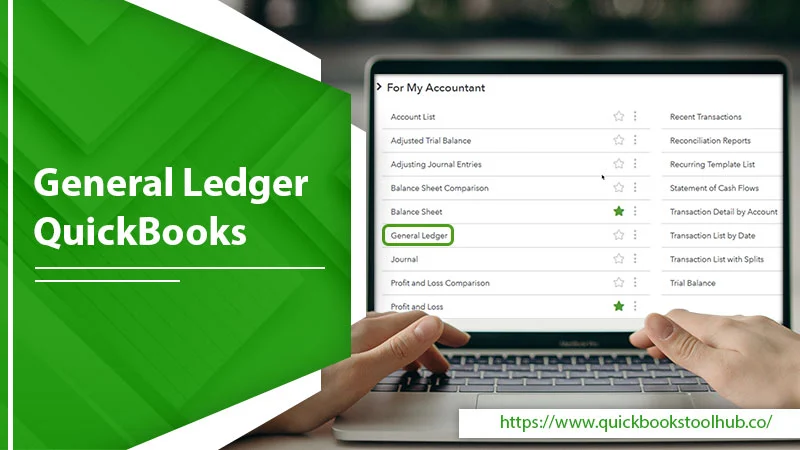

- Go to the area ‘For my accountant.’

- Here, select ‘General Ledger.’

- You can now opt for a date range for this report.

- Choose ‘Customize‘ and review the preferences.

Create General Ledger Entries in Your QuickBooks

You can make entries of the funds that are not deposited in QuickBooks. Here is the exact process for it.

- Launch QuickBooks and head to the menu.

- Tap the ‘Company‘ dropdown.

- Now choose the option ‘Make General Journal Entry.’

- Choose the ‘Date‘ field. Here, select the suitable date for entry.

- In the ‘Entry No.‘ field, input a value for this entry.

- Using the ‘Account‘ dropdown, choose the one you wish to employ for the debit.

- Give the transaction’s debit value in the column of ‘Debit.’

- If you wish to add any message to the entry, do so through the ‘Memo‘ field.

- Now input the remaining data by adding the vendor, customer, and transactional entry name.

- Then use the credit to show a deposit by inputting another transaction.

- After the transaction comes to 0, tap ‘Save & Close.’

Steps to Run the General Ledger Report QuickBooks Desktop

Running General Ledger in QB is essential to generate the report. Here is the procedure to execute it.

- Launch QB and head to ‘Menu.’

- Now tap ‘Reports.’

- Choose the ‘All‘ option.

- Now go to the screen’s end part and locate the ‘For My Accountant’ option.

- Tap on this option, and after that, choose ‘General Ledger.’

- After that, select the transaction’s date range and choose between ‘Cash‘ or ‘Accrual Basis.’

- Finally, tap ‘Run report.’

Read About:- QuickBooks Advanced Inventory

How to Print General Ledger in QuickBooks

You can print the monthly activity of the General Ledger and the year-to-date activity. The guidelines for both are mentioned below.

Printing General Ledger (monthly activities)

It’s easy to print General Ledger (monthly activities). Use these easy pointers to print it.

- Head to ‘Print Reports’ and then to ‘Transaction Reports.’

- Now, choose ‘General Ledger.’

- You can now input a month and year.

- Let the account range fields remain blank. It will print the whole General Ledger. If you enter a range, it will cause an out-of-balance error.

- But if you do want to print General Ledger for an account range, input the starting and ending account numbers.

- Now, choose ‘Print‘ followed by ‘Begin printing.’

- Lastly, opt for the ‘Print to printer’ option.

How to print cumulative General Ledger (year-to-date activities)

The process of printing cumulative General Ledger begins in the same manner as the previous one. Head to ‘Print Reports‘ followed by ‘Transaction Reports‘ and opt for ‘Cumulative General Ledger.’

- Now, you must enter a starting and ending date.

- Keep in mind that it is in the same calendar year.

- Now, opt for ‘Print‘ followed by ‘Begin printing.’

- See the preview and choose ‘Print to the printer.’

Read About:-Quickbooks Update Error 1603

Final Thoughts

The General Ledger QuickBooks gives you crucial data about the way your business manages its resources. After you understand the process of creating and printing journal entries, you can start doing so manually. Use this article as a handy guide whenever you need to print a General Ledger report. If you need more clarity on any part of General Ledger, contact a QuickBooks technical support service.

FAQ

Q. What is a General Ledger in QuickBooks?

A. General Ledger in QuickBooks is a centralized record of all financial transactions for a business. It includes accounts for the assets, income, liabilities, equity, and expenses. General Ledger is the foundation for the rest of the accounting system, and its information is used to generate financial statements and reports. General Ledger is updated every time a transaction is recorded in QuickBooks.

Q. How can I access General Ledger in QuickBooks?

A. To access General Ledger in QuickBooks, go to the “Lists” menu and select “Chart of Accounts.” From there, you can view, add, and edit accounts within General Ledger. You can also run a “General Ledger” report to see a detailed breakdown of all transactions in each account.

Q. What information is included in a General Ledger report in QuickBooks?

A. A General Ledger report in QuickBooks includes information about all transactions in each account within General Ledger. This includes the date of the transaction, the account it was recorded in, the amount, and a description of the transaction. The report can include specific accounts, date ranges, and other criteria.

Q. How does General Ledger in QuickBooks help with financial reporting?

A. General Ledger in QuickBooks provides the information necessary for accurate financial reporting. The information in General Ledger is used to generate balance sheets, income statements, and other financial reports. This information provides a clear picture of the financial health of a business, including its assets, liabilities, equity, income, and expenses. By using QuickBooks to keep the General Ledger up-to-date, business owners can ensure that their financial reports are accurate and up-to-date.

1 Comment

What Is General Ledger Report QuickBooks and How to Make It? · October 25, 2022 at 10:43 am

[…] Then tap ‘General Ledger.’ […]